Legal Umbrellas of Life’s Storms

May 27, 2021

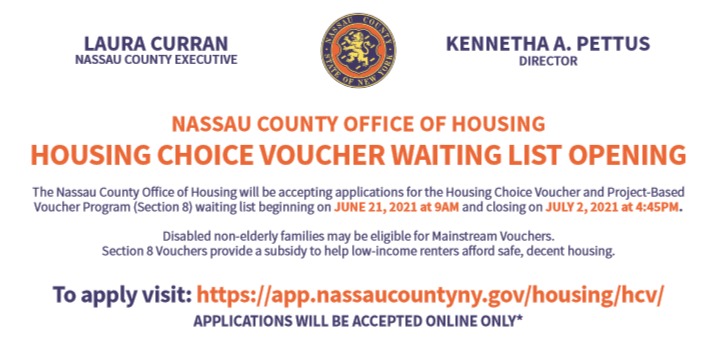

Nassau County’s Housing Choice Voucher Program Waiting List Application: NOW OPEN

June 22, 2021Download a PDF Version

Dealing with My Bills

- Questions about this month’s bills

- Rent and Mortgage Payments

- Telephone and Other Utility Services

- Credit Cards/Debit Cards

- Student Loans

- I owe money to New York State. What can I do?

- More Resources for Managing your Bills

Dealing with Debt Collection

- A debt collector or creditor has threatened to take me to court. What can I expect?

- My income is currently being garnished because of old consumer or medical debt. Can I stop the deductions from my paycheck?

- I received a notice from the sheriff that they will start garnishing my income. What can I do?

- I received a stimulus check this year, can it be taxed or garnished?

Dealing with My Bills

Questions about this month’s bills

Many people are struggling financially because of the pandemic. If you cannot pay your bills, check with service providers about what options they offer. Some providers may want you to document financial hardship to qualify for special programs. More information about some of the major relief programs is below.

Rent and Mortgage Payments

Click here to read our FAQs on evictions and foreclosure and mortgages.

Telephone and Other Utility Services

In New York, utility companies cannot shut off your service during the pandemic if you haven’t paid your bill because of financial hardship. This restriction applies to utility companies that provide:

· Electricity

· Gas

· Water

· Internet

· Cable Television

· Phone Service

If you can’t pay a utility bill during the shut-off restriction, your utility company is required to let you enter a deferred payment agreement without a down payment, late fees, or penalties.

The shut-off restriction will end on the earlier of two dates: (1) 180 days after Governor Cuomo ends the COVID-19 state of emergency, or (2) on June 29, 2022.

More information is available from the NY Department of Public Service. COVID-19 Moratorium on Utility and Municipal Shutoffs (ny.gov)

Emergency Rental Assistance Program

If you had trouble paying your rent, electricity or gas bills during the pandemic, you may be eligible for relief under the Emergency Rental Assistance Program (ERAP). Under this program, renters can receive relief for up to 12 months of unpaid rent, up to 12 months of unpaid gas or electric bills, and 3 additional months of rental payments if you spend 30% of your monthly income on rent.

ERAP payments are made directly to your landlord or utility provider. You must meet the following conditions to be eligible for ERAP:

- Your household income must be below 80% of the Area Median Income. Check this link to determine your status.

- You or a member of your household received unemployment benefits, lost income, suffered significant costs, or experienced financial hardship because of the pandemic.

- You pay rent at your primary residence and have overdue rent bills owed after March 13, 2020.

- You are at risk of homelessness or housing instability because of unpaid rent or utility bills.

If you apply for ERAP assistance, you can’t be evicted for unpaid rent or utilities covered by ERAP relief unless your application is denied. Use this link to apply for ERAP assistance. The Towns of Hempstead, Islip, and Oyster Bay are accepting ERAP applications themselves. If you live in one of these towns, please use these links to apply for ERAP:

· Town of Oyster Bay program is not open as of June 2, 2021

Credit Cards/Debit Cards

New York has urged banks to waive overdraft fees, credit card late fees, and ATM fees during the pandemic. Check this link to determine if your financial institution is required to waive these fees. If you think you were unfairly charged a fee, learn more about filing a complaint with the New York Department of Financial Services.

Learn more about asking your credit card company for help here.

Student Loans

The New York Department of Financial Services has information for Student Borrowers during the pandemic at this link.

If you lost your job or income because of the pandemic, you can use this free tool to enroll in an income-based repayment plan. Depending on your circumstances, you may qualify for $0 payments for a year.

I owe money to New York State. What can I do?

New York isn’t collecting medical and student debt owed to the State until at least May 31, 2021. This suspension does not apply to private creditors. If you owe other debts to New York State, you can also apply for a temporary suspension using this link. If you need more help, please call the Attorney General’s hotline at 1-800-771-7755.

More Resources for Managing your Bills

· Consumer Financial Protection Bureau – protect yourself financially from the impact of the coronavirus

· National Consumer Law Center – Major Consumer Protections Announced in Response to COVID-19.

· New York Legal Assistance Group – Planning – Tips to reduce spending and save money

· Paul Weiss Coronavirus Relief Center

· USA.gov – Help with Bills

Dealing with Debt Collection

A debt collector or creditor has threatened to take me to court. What can I expect?

A debt collector or creditor has threatened to take me to court. What can I expect?

Debt collection cases have been proceeding normally in the courts. If you received a Summons and Complaint for a debt collection action in a New York State court, you can use this form to respond to the Summons and Complaint. Contact us to see if you qualify for assistance from the Consumer Debt Unit.

You can also contact your debt collector to request a payment plan or extension. The Consumer Financial Protection Bureau offers many resources for contacting and negotiating with debt collection companies.

My income is currently being garnished because of old consumer or medical debt. Can I stop the deductions from my paycheck?

It may be possible to stop your payment from being garnished if you file an order to show cause. More information about options about voiding a wage garnishment order is available here. Contact us to see if you qualify for assistance. Self-help forms are also available here.

I received a notice from the sheriff that they will start garnishing my income. What can I do?

Wage garnishment to pay the private debt has not been suspended. The normal process for garnishments can be found here.

I received a stimulus check this year, can it be taxed or garnished?

No, stimulus payments aren’t taxable. If you receive one, you don’t have to report it on your taxes. The federal government won’t garnish stimulus payments for back taxes or federal student loans. New York State has also prohibited private creditors from garnishing stimulus payments. Stimulus payments can still be garnished for unpaid child support, spousal support, or alimony. Please see these New York Times articles for more information:

- “F.A.Q. on Stimulus Checks, Unemployment and the Coronavirus Bill.” (Provides more information about the March 2020 stimulus bill)

- “What Is in the Stimulus Bill: $1,400 Checks, Expanded Unemployment and Tax Rebates.” (Provides more information about March 2021 stimulus bill)