Moratorium On Utility Disconnects Ending Soon

March 5, 2021

Coordinated Legal Advocacy Helps Secure Home Loan Modification For Survivor Of Domestic Violence

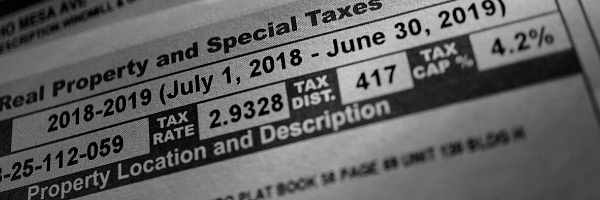

March 16, 2021Property tax arrears can put older adults at risk of both mortgage foreclosure proceedings and tax lien foreclosure proceedings. Nassau Suffolk Law Services’ Foreclosure Prevention Unit recently assisted an 83-year-old woman who was facing foreclosure during the pandemic as the result of a tax lien a speculator purchased from Nassau County for just $326.THE REVERSE MORTGAGE FORECLOSURE PROCEEDINGThe homeowner originally contacted the NSLS Foreclosure Prevention unit in 2019 when the reverse mortgage on her home went into foreclosure. The client, who has serious health issues including cancer, had fallen behind on her property taxes. This triggered a default on her HUD-insured, reverse mortgage, known as a Home Equity Conversion Mortgage (“HECM”). As a result, the mortgagee (Champion Mortgage Company) started a foreclosure action. Through the advocacy of our Foreclosure Prevention Unit during the mandatory settlement conference process, the client was granted an “At-Risk Extension” extending the time before the mortgagee could proceed with the foreclosure process.”At-risk extensions” are part of HUD’s loss mitigation guidance for HECM borrowers. Eligibility for an at-risk extension requires the homeowner to be 80 years of age or older. The borrower must show that they face critical circumstances that warrant an extension for one year, with the opportunity to request additional extensions at the end of the one-year period. HUD’s guidance identifies the following critical circumstances that would justify an at-risk extension:

- Terminal illness

- Long-term physical disability of the borrower, or

- Unique occupancy need.

THE TAX LIEN FORECLOSURE PROCEEDINGWhile the at-risk extension and COVID-19 related moratoria on foreclosure stayed proceedings in the reverse mortgage foreclosure action, there was no moratorium on tax lien foreclosures for much of 2020. in July 2020, a third-party speculator served our client with a new Summons and Complaint for tax foreclosure.In Nassau County, tax-speculators can purchase tax liens, often at costs far less than the value of the home, at the County’s annual tax lien sale. The tax-speculator pursuing the new foreclosure action against our client had purchased her Nassau County tax lien for the grand sum of $326, against a property appraised at around $400,000. Shortly after receiving our answer to the new complaint, Champion satisfied the tax lien. As a result, the tax speculator moved to discontinue the tax foreclosure action preserving the homeowner’s housing for the time being.TAX FORECLOSURE MORATORIUMTax lien foreclosures remain a threat to other seniors during the pandemic. The COVID-19 Emergency Eviction and Foreclosure Prevention Act applies to tax lien sales and foreclosures. Under the Act, homeowners may submit a Hardship Declaration (available here) to the enforcing officer or entity conducting the tax lien sale or foreclosure. If the homeowner returns the hardship declaration, no further action to collect the tax debt can take place until after May 1, 2021.Any entity seeking to file a new tax foreclosure must provide the homeowner a copy of the hardship declaration at least thirty days before selling a tax lien or prior to filing a new tax foreclosure action. While this hardship declaration is similar to the one designed for homeowners facing foreclosure on a mortgage (available from NYCourts.gov), homeowners with a reverse mortgage or others who pay their property taxes directly may need to complete both forms to be fully protected.The COVID-19 pandemic has resulted in widespread health and economic distress for older adults. For borrowers with reverse mortgages who are facing foreclosure, as well as older homeowners who face tax lien foreclosures, federal and state protections provide temporary relief, allowing them to stay in place. But these protections will expire in the near future and borrowers must rely on existing foreclosure avoidance options to save their homes.Homeowners who need help determining whether to complete the tax or mortgage hardship declaration or who are facing foreclosure should contact NSLS or a HOPP-funded housing counselor for assistance.